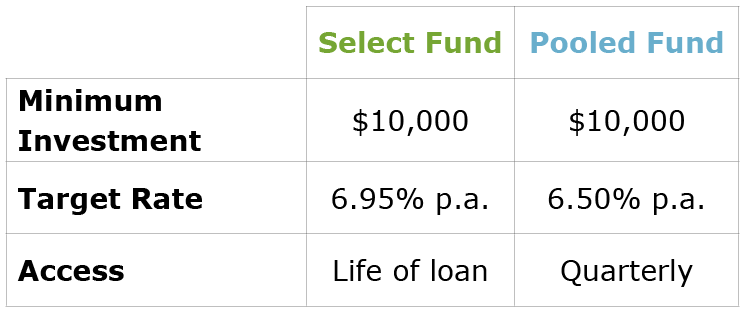

Some of our newer investors may only be familiar with the GPS Invest Pooled Fund, as it has primarily been the fund taking new investment over the past few years.

In fact, the original core product offered by GPS was the GPS Invest Select Fund.

With both funds, you invest directly in first mortgages over real property in South East Queensland.

However, there are some differences between the funds that allow investors to choose a way to invest that suits them.

The Select Fund is a contributory mortgage scheme. Investors can select a mortgage based on the information presented in a Supplementary Product Disclosure Statement (‘SPDS’). You can then invest your funds directly into that loan.

The Select Fund will be the first to take on new money next year. The best way to stay informed when new loans become available is to register with our Investor Services team to receive the new opportunities alert email.

When you invest in the Pooled Fund, your investment is spread across a range of loans within the GPS portfolio. The benefit with this fund is achieving greater diversity of loans, with no downtime between investments.

There are many more details about each fund you need to know before investing. If you are interested in knowing more, please visit our ‘Invest’ page or call Richard, Bruce or Courtney on 1800 999 109.

GPS Invest Select Fund (ARSN: 149 257 401) and GPS Invest Pooled Fund (ARSN: 149 257 410) (“the Funds”) are issued by GPS Investment Fund Limited (ABN: 40 145 378 383) (AFSL: 383080) (“GPS”). This document may contain general advice which does not consider any particular person’s objectives, financial situation or needs. GPS is not licensed to provide financial product advice about the Funds, so you should obtain a Product Disclosure Statement (“PDS”) and read it prior to making a decision to invest. You should also consider obtaining professional financial advice before making an investment decision. The PDSs are available at www.gpsinvest.com.au or by calling 1800 999 109. Cooling-off periods do not apply to the Funds. Past performance is not a reliable indicator of future performance. An investment in either Fund has risk, can fluctuate in value, may achieve lower than expected returns, is not a bank deposit, is not guaranteed and investors risk losing some or all of their principal investment. Distributions, if any, will generally be paid monthly. GPS Invest Pooled Fund has limited withdrawal rights. Withdrawal offers will generally be made quarterly, subject to available liquidity. GPS Invest Select Fund withdrawals will only be considered at the completion of a mortgage investment. Refer to the relevant PDSs for full details.