In the world of investing there are lots of options – shares, cryptocurrency, NFTs and many more, where you hope that your knowledge of the investment type produces more wins than it does losses. You must hope that when you need the money the market is having a good day, and then cross all your fingers and toes that a recovery happens after a drop. Not to mention the stress of trying to decide when to buy, and when to sell to maximize profit!

It is a great thing then that you have chosen to invest in Registered First Mortgages with us!

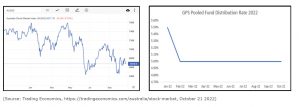

Having a look at the graphs below should tell you everything about where this article is going.

Both graphs represent the performance of that particular investment for 2022 so far. The first, being the Australian Share Market and the second being the GPS Invest Pooled Fund. The obvious comparison to be made is in the sawtooth movement of the share market vs the straight line, stable return of GPS.

Consistency is important when it comes to making sure that you get the most out of your invested dollars. This is not only in reference to dollars earnt, but also peace of mind! The constant stress of what to do with those see-sawing returns is not what some of us need in our lives. A nice consistent return allows a certain extent of assurance, that is not to be underestimated.

This straight line from GPS is not something that occurs via fluke or good luck. It is something that GPS works hard to maintain to provide the best possible outcome for our investors. This is, and always has been, the main focus of GPS and offers a unique point of differentiation.

The relationships that we have with our borrowers, and the fantastic team within GPS, means that we have more control over our returns than others, as we can make decisions that keep our cost of funds low. It is also important to note that because our rates are not dependent on major external forces such as the RBA, we don’t fluctuate when they do! All of these separate GPS from the others.

While you may find that other investments give you the ability to produce a higher return quicker, or even other registered first mortgage funds offering a higher rate, it is important that the consistency of their returns is taken into consideration. An investment/fund that offers higher rates now, but was lower 3 months ago, may ultimately work out the same, but with greater risk of future negative fluctuations.

Is that a risk you are comfortable with?