Insights from GPS Investment Fund Limited (GPS) Executive Director, Ben O’Hara

In early January, during the peak of the post-New Year relaxation period, the Financial Review quietly published an insightful article on the generational transfer of wealth, which highlighted how Generation X (Gen X) now holds greater wealth in housing than the Baby Boomers.

However, while Gen X leads in property wealth, the preceding Baby Boomer generation possess significantly more cash reserves, primarily held in businesses, superannuation, and other investments. Overall, Baby Boomers remain the wealthiest generation in terms of net worth.

The article also commented that, in time, this wealth will transfer down to the next generation and it’s envisioned that Baby Boomers begin passing on their assets with the expectation that it will help GenX reduce its substantial property debts – which are the highest of any generation.

This transitional expectation, however, underscores the importance of planning for the intergenerational wealth transfer.

Without consideration and planning – something which we have discussed in previous newsletters – families risk falling victim to the old Scottish proverb of “Shirtsleeves to shirtsleeves”, what is defined as a recurring pattern where the first generation works hard to build wealth, the second enjoys its benefits, and the third often reverts it back to square one.

I first came across this term in the biography of Kerry Packer, by Paul Barry, in 2008, which posed a similar question about the future of the Packer family fortune. And while that is a dilemma of a grand scale, the challenges of mitigating financial loss for future generations is a question which impacts every family.

At GPS, we have observed a growing number of investors taking proactive steps to guide their children, and grandchildren, into the world of financial investments. Many are opening accounts in their children’s names to teach them the values of patience through long-term investing.

This compound interest-first approach to wealth transfer then puts them one step ahead, without the need to engage in high-risk options which are so commonly sought out by younger generations in a bid to ‘get rich quick’.

To illustrate the power of compounding interest: if you invested $10,000 today at a 7% target return, the investment would grow to $20,097 in 10 years (101% growth).

Then, in over 30 years, it would increase to $81,165. This is a 712% growth over 30 years, which is a 24% p.a. simple return.

In contrast, if you withdrew the $700 annual interest and did not reinvest it, your total return after 30 years would only amount to $31,000.

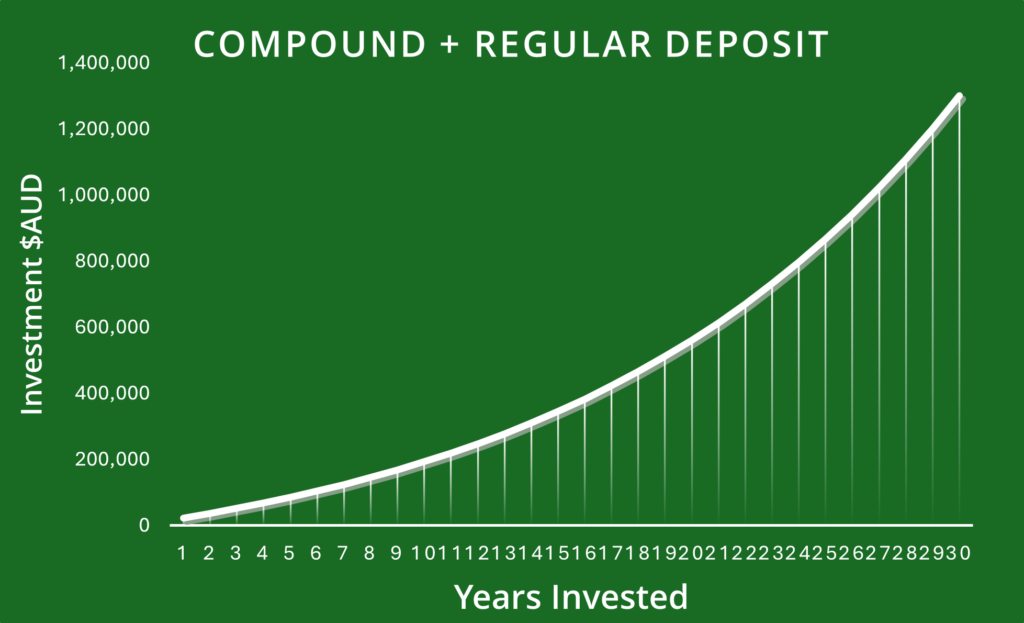

The difference is stark, highlighting the exponential potential of reinvestment. Then, this impact becomes even more pronounced when regular contributions are added.

For example, if you invested $10,000 initially, contributed $1,000 monthly, and let the interest compound at 7%, the total value of your investment after 30 years would be an impressive $1,301,136. This figure comprises the original $10,000 investment, $360,000 in contributions, and $931,136 in compounded interest and demonstrates a potential return of 12,911% on the original $10,000 investment, or 430% p.a. simple return:

So, does GPS enable investors to benefit from compounded interest? Absolutely! Our entire range of GPS pooled funds offer compounding interest distributions that both new and well-experienced investors can benefit from.

We’re always available to speak with you, or anyone you know, about how our compounding interest investment fund opportunities can work for you during any stage of your investment journey: